I am a late comer to the investing world at 32 but hey it’s better late than never. I started investing on roboadvisors February 2019. I picked 3 platforms :

- Smartly.sg

- StashAway

- CIMB CGS eWealth

A little while after that, I decided to start investing via DCA (Dollar Cost Averaging) on Singapore stocks as well. So I signed up for a brokerage account via Maybank Kim Eng for their RSP (Regular Savings Plan). This turned out to be the worst investment decision of my life. Why? Because they shut down the Monthly Investment Plan 3 months after I signed up. Hence, I was left with a few counters to liquidate before end of year. What most financial bloggers didn’t tell you is that the selling price for odd shares are super low! The worst part of Maybank Kim Eng’s termination of the plan is they only give you time until December 2019 to sell each of your counters at $10 each! After that you’d have to cough up $40 per counter!

So, no. Please stay away as far as possible from RSP (Regular Savings Plan). They’re really not worth your time. Either you invest in a roboadvisor or aggregate your savings and invest once the commission makes sense.

Over the course of the year, CIMB eWealth terminated their service in September 2019. They gave me 2 options : 1 is to liquidate my account and transfer into a money market fund and the other is to liquidate and withdraw as cash. I chose the latter. In 4 months I received 4.82% yield. Not too bad.

I also withdrew my money from Smartly.sg on November 2019 as I was spooked by their email. They are not accepting any new deposits. In my opinion, they’re handling this really badly. I mean, you’re a startup and when it’s about money, trust is the most important. I still remember in the months leading to 1998 IMF crisis in Indonesia, people were withdrawing money if there were any negative rumours on certain banks. If you think about it, when customers rushed for deposits, whether rightly or wrongly, banks would be facing a liquidity crisis. I remember after that, Indonesian government issued a new regulation guaranteeing depositor’s savings up to a certain amount. I believe it’s Rp. 2 billion right now.

From Smartly.sg, I received a 6.8% return for a period of 9 months. It could have been more, however Smartly.sg re-balanced my portfolio. I attached the email from them below :

On a broad basis, we’ve moderately reduced exposures to equities and moved focus away from European, Japanese and emerging markets to a broad cross section of US growth and dividend paying stocks. In addition, alternative risk assets have been shifted from gold to energy resources, for added diversification.

Simultaneously we’ve assigned more priority to non-US developed government bonds and short term US government debt, while shifting away from US Municipal bonds.

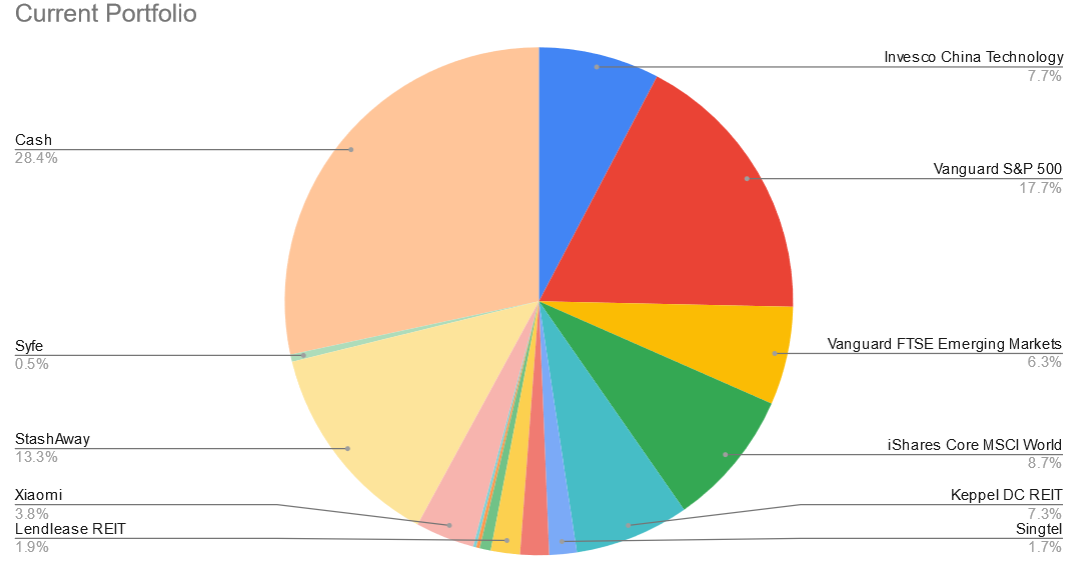

What happened was stocks rallied and I missed the rally or else I’d be getting even better returns. Since we will never be able to control what Roboadvisor services invest on and when they’re re-balancing, I decided to open a new brokerage account for me to invest on.

In retrospect, I have to say I’m pretty lucky. I started investing during one of the best time to do so as the market had just had a major correction (the trough was during December 2018) and was starting to recover.